The blog details how Godrej Capital bridges the gap between ambition and homeownership through a "concierge finance" model. Key highlights include digital-first sanctions in under 24 hours, the Aarohi scheme for women, and flexible repayment tools like "Design Your EMI" (offering up to 48 months of interest-only payments). It also emphasizes the 2026-27 regulatory tailwinds, such as reduced RBI risk weights and PMAY-U 2.0 subsidies, which together make luxury homeownership more accessible and cash-flow friendly for young professionals.

For the modern Indian professional, the leap from a high-growth career to homeownership often feels like a daunting financial hurdle. You have the income, the ambition, and the credit score, but the traditional banking system often feels slow, rigid, and disconnected from your reality. If you are eyeing a Godrej property, the journey doesn't start with a down payment—it starts with understanding a financial ecosystem designed specifically for your life stage.

1. In-House Synergy and Concierge Finance

Godrej Capital’s finance team is embedded within the Godrej Properties structure, allowing for unique synchronization between construction stages and loan release.

- Rapid Sanctions: Salaried individuals can receive a digital sanction letter in under 24 hours.

- Fee Optimization: Reduced or waived sanction fees are available for target groups, including women via the Aarohi scheme and professionals like Doctors or CAs.

- Milestone Alignment: In-house teams track project progress in real-time, ensuring disbursements match demand letters exactly to prevent early interest accrual.

2. Multi-Bank Connectivity

If a buyer’s profile is non-standard, the Godrej finance team acts as a bridge to major national banks.

- Co-Lending Partners: A landmark partnership with the Central Bank of India provides up to 80% funding at bank-level base rates while maintaining Godrej’s digital customer experience.

- Primary Choice: Connections to premier lenders like SBI and HDFC ensure buyers access the widest capital pool and lowest floor rates.

3. Digital-First Disbursement

The zero-touch loan process utilizes a sophisticated API infrastructure for instantaneous verification.

- Instant Validation: Real-time links to UIDAI (KYC), GSTN (Income), and credit bureaus (CIBIL > 750) trigger automated Green Channel approvals.

- Pre-Approved Valuations: Godrej project units carry pre-verified legal and technical status, removing valuation delays.

4. Regulatory Shifts: RBI Risk-Weight Norms (2027)

The RBI’s proposed framework reduces capital requirements for housing loans, incentivizing first-time buyers with lower rates.

| Loan-to-Value (LTV) Ratio | Existing Risk Weight | Proposed Risk Weight (2027) | Expected Impact |

|---|---|---|---|

| 50% | 35% | 20% | Lower rates for high-down-payment buyers |

| 50% - 75% | 35% | 25% | Increased credit for the middle segment |

| > 75% | 75% | 40% - 50% | Better terms for first-time buyers |

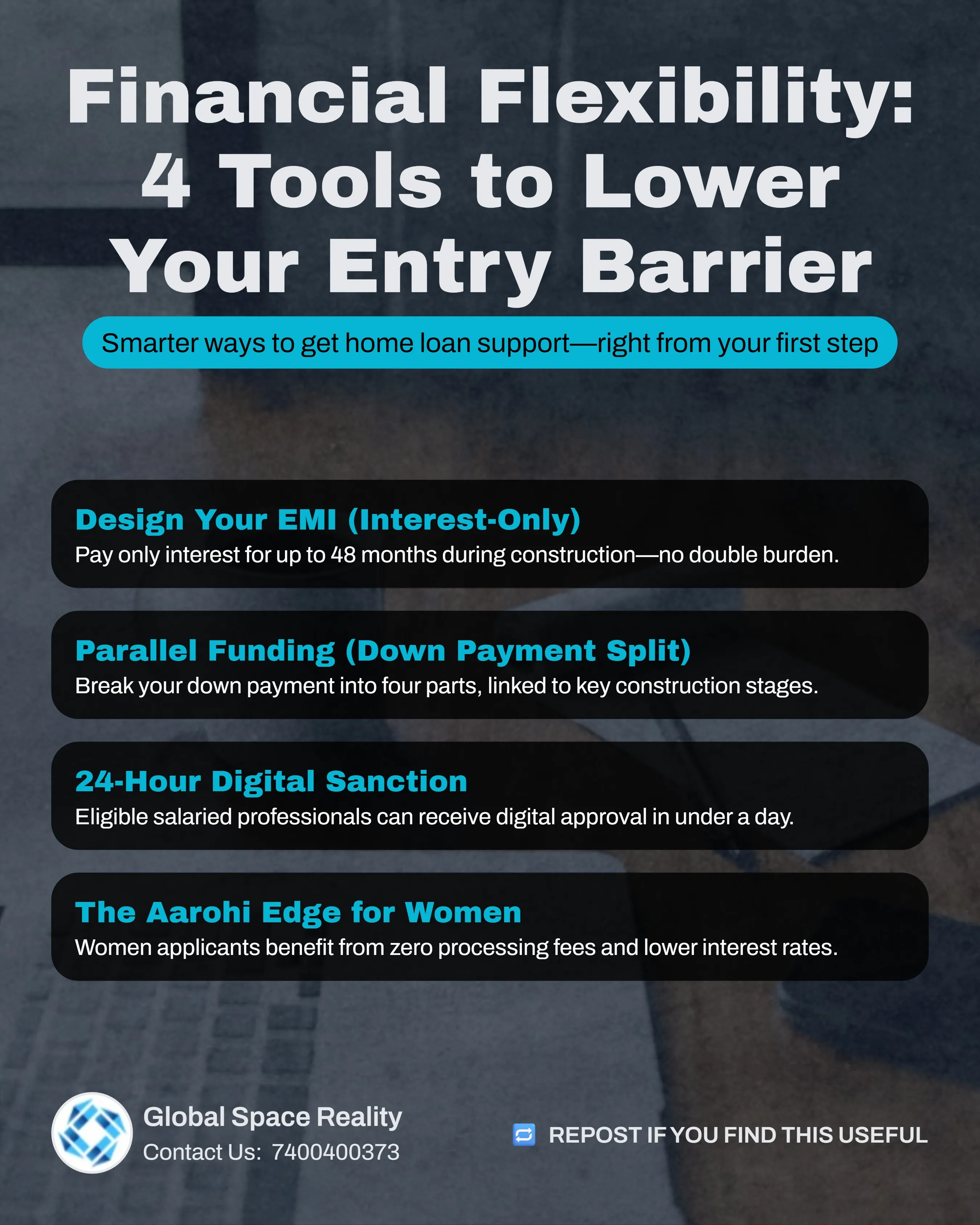

5. Design Your EMI: Enhanced Cash Flow Management

One of the most innovative features of the Godrej finance system is the Design Your EMI toolkit. As a young professional, your income today is likely a fraction of what it will be in five years. Why should your EMI be static?

- Interest-Only Period: Pay only interest for up to 48 months during construction to avoid the double burden of rent and full EMI.

- Flexi Funds: An overdraft-like facility for business owners to withdraw and repay as per their own cash flow.

- Parallel Funding: Stagger the 10-20% down payment across various construction stages to lower the entry barrier.

Leveraging the RBI Advantage

The regulatory environment in 2026 is working in your favor. With the RBI proposing reduced risk weights for housing loans with LTVs up to 90%, lenders are more incentivized than ever to offer competitive rates to first-time buyers. When you combine this with the PMAY-U 2.0 subsidy—which can provide a benefit of up to ₹1.8 lakh for households with annual incomes up to ₹9 lakh—the effective cost of your luxury home drops significantly.