The blog explores the "Golden Window" for women buyers in 2026, driven by financial autonomy and the Aarohi Home Loan. Key financial perks include interest rate concessions (up to 0.10%), waived processing fees, and a 1% stamp duty rebate in states like Maharashtra. Beyond finance, the loan offers a unique health security bundle covering maternity and critical illness. With flexible tools like Parallel Funding and the PMAY-U 2.0 subsidy, Godrej Capital empowers women to transition from co-applicants to primary owners, building a long-term financial legacy.

In a landmark year for financial independence, Indian women are actively reshaping the real estate landscape, moving from co-applicants to primary decision-makers. This pivotal shift is supported by a unique convergence of rising financial autonomy and supportive government policies. To honor this empowerment, Godrej Capital has tailored the Aarohi Home Loan for Women—a product that goes beyond a mere interest rate cut, offering fiscal savings, innovative repayment flexibility, and essential health security, making 2026 the most strategic time for women to build their legacy of homeownership.

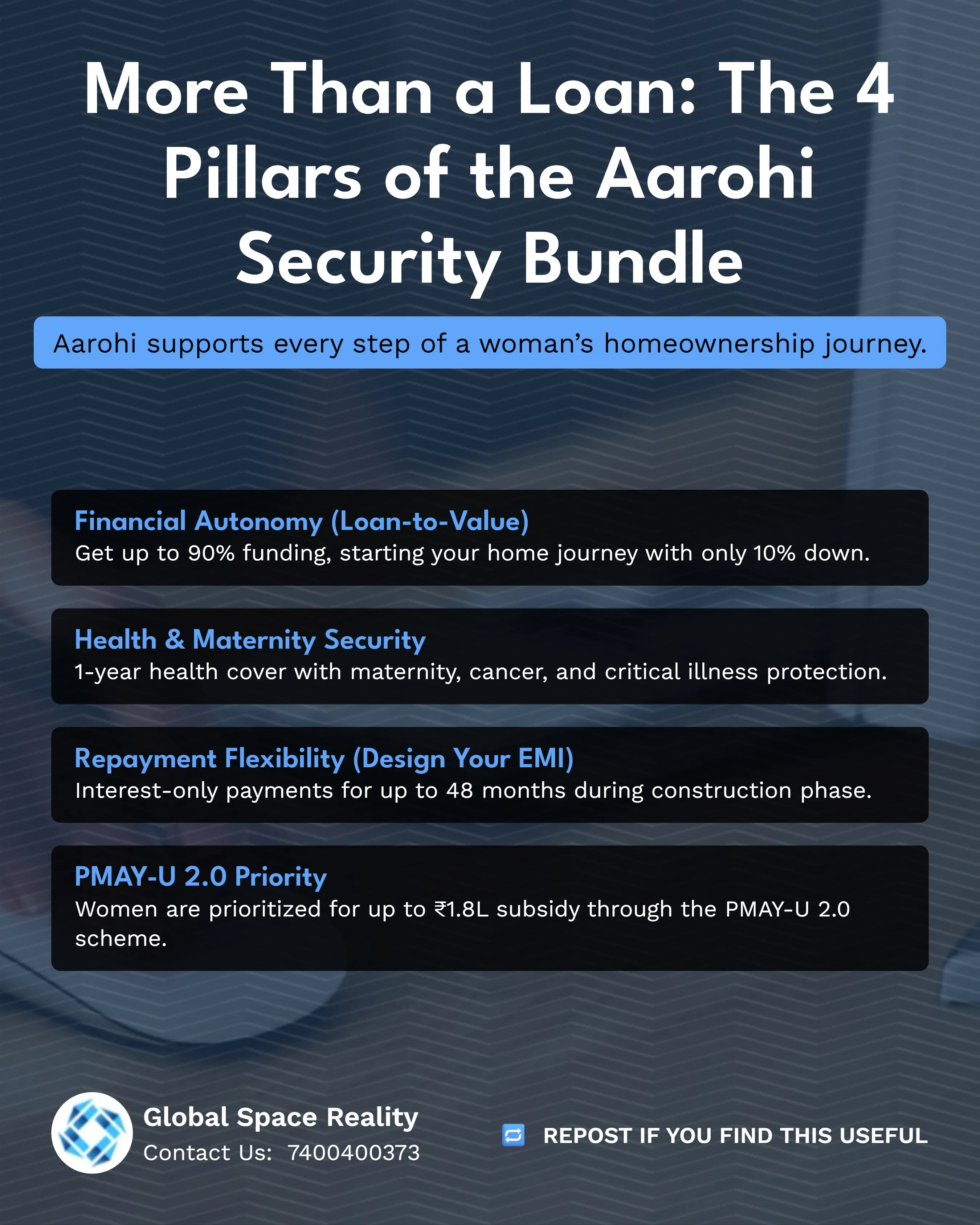

1. "Aarohi" Empowerment for Women

Tailored for the rising demographic of women decision-makers, offering long-term financial security.

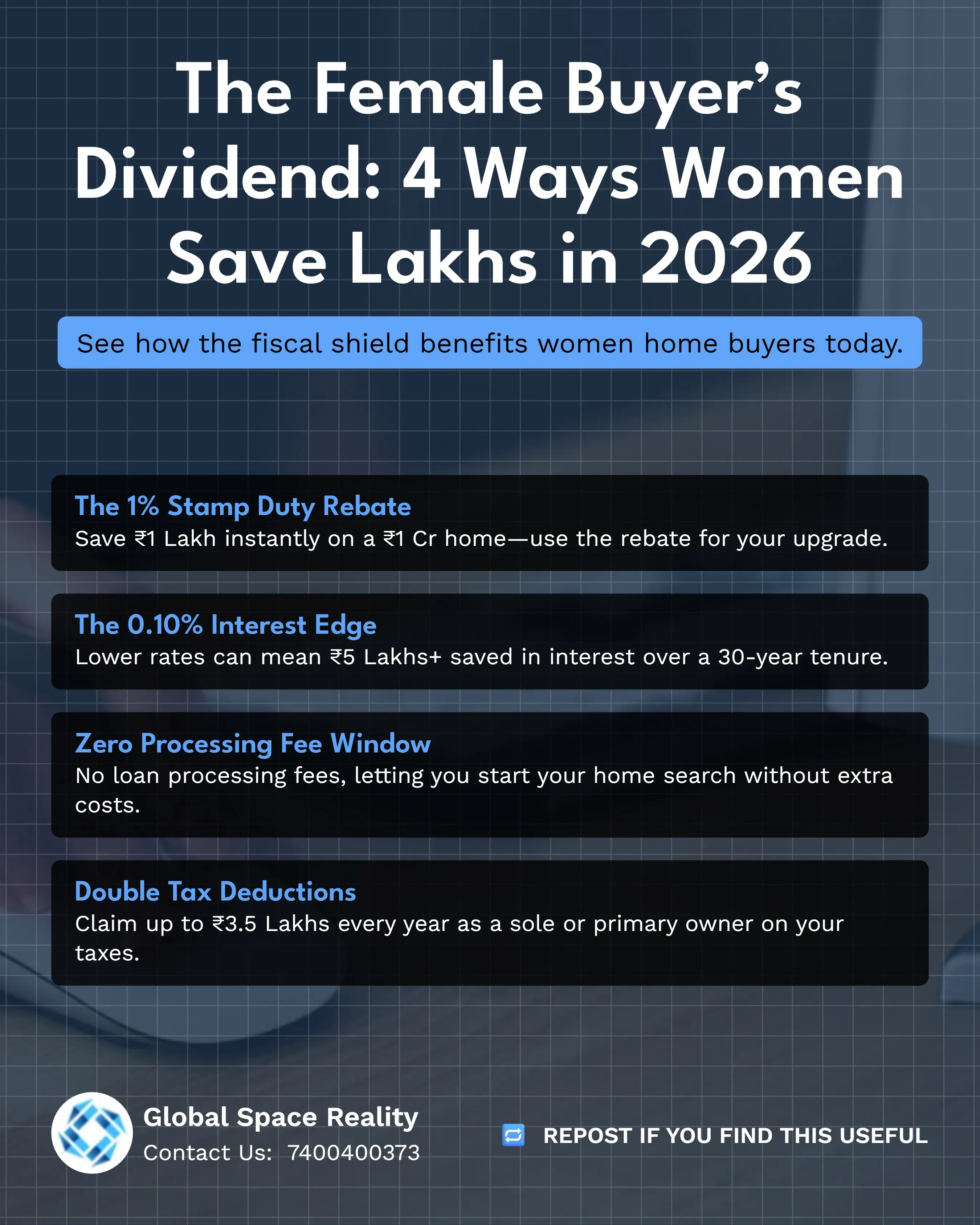

- Financial Cuts: Interest rate reductions of 0.05% to 0.10%, saving over ₹5 lakhs on a ₹1 crore loan over 30 years.

- State Rebates: 1% stamp duty discount in Maharashtra (for sole ownership) and 2% in Delhi and Haryana.

- Health Security: Bundled one-year complimentary health cover including maternity, cancer, and critical illness protection.

2. Innovative Repayment Models

- Design Your EMI: Choose an interest-only period for up to 48 months during construction to avoid the "double burden" of rent and full EMI.

- Parallel Funding: Share the 10-20% upfront down payment load by staggering your contribution across various construction stages.

- Flexi Funds: An overdraft-like facility allowing business owners to withdraw and repay as per their monthly cash flow.

3. 2026 National & State Housing Schemes

PMAY-U 2.0: Offers a 4% interest subsidy on the first ₹8 lakh of a home loan, providing a total benefit of up to ₹1.8 lakh for households earning up to ₹9 lakh/year.

Haryana (DDJAY): The gold standard for plotted housing, allowing for independent floor registry and separate bank loans for each floor on a single plot.

West Bengal: Schemes like Nijashree build flats on government land to lower costs for LIG/MIG segments, while Banglar Bari aims to allocate 16.3 lakh houses by early 2026.

4. Policy Outlook: Budget 2026-27

The upcoming budget is expected to address critical inflection points in urban housing affordability.

- Affordable Definition: Industry push to raise the "affordable" price cap from ₹45 lakh to ₹90 lakh, unlocking 1% GST benefits for more urban projects.

- Tax Incentives: Potential increase in Section 24(b) interest deductions from ₹2 lakh to ₹4 lakh and expanded standard deductions for rental income.

- Risk Weights: RBI’s proposed recalibration (as low as 20% risk weight for high-equity loans) will lower capital costs for lenders, leading to better rates for first-time buyers.

The Aarohi Advantage: More Than Just a Lower Rate

The Aarohi Home Loan for Women is a specialized product designed to recognize the financial discipline and unique life stages of women borrowers. While many lenders offer a 0.05% interest rate concession for women, Godrej Capital goes further:

- Zero Processing Fees: For salaried women, the typical processing fees are waived, reducing the upfront friction of taking a loan.

- Integrated Health Cover: We understand that homeownership is a long-term commitment. Aarohi loans come with a complimentary one-year health cover that includes maternity, cancer, and critical illness protection. It’s our way of ensuring that your health and your home are secured together.

Tax Benefits and Stamp Duty Savings: The Financial Logic

Registering a property in your name is a move that makes immense fiscal sense. Most Indian states, including Maharashtra and Delhi, offer significant stamp duty rebates for women. In Delhi, for instance, a woman pays 4% stamp duty compared to 6% for a man. On a ₹1 crore property, that is an immediate saving of ₹2 lakhs—enough to fund your new home’s modular kitchen or a significant portion of your interiors.

Furthermore, the Income Tax Act provides robust deductions under Section 24(b) (up to ₹2 lakh on interest) and Section 80C (up to ₹1.5 lakh on principal). If you are a first-time buyer, additional benefits under PMAY 2.0 can bring your effective interest rate down by 4% on the first ₹8 lakh of your loan, provided your household income meets the criteria.

Building a Legacy

Real estate remains one of India’s most reliable wealth-building assets. For women, owning a home is a step toward long-term financial security and legal empowerment. Whether you are looking at an under-construction project where you can split your down payment through Parallel Funding or a ready-to-move-in apartment where you can pay Interest-Only for the first year, the Godrej finance ecosystem is your partner in this journey.

Conclusion: Synthesizing the 2026 Financial Paradigm

The research into the Godrej Capital finance system and the broader Indian regulatory framework reveals a clear trend toward democratized, data-driven, and demographic-specific lending. The convergence of the RBI’s risk-weight recalibration and the digital speed of Godrej’s in-house finance team has effectively lowered the activation energy required for homeownership.

Key Takeaways: The Digital Premium (24-hour sanctions), Regulatory Tailwinds (lower risk weights), and the Gender Opportunity (Aarohi benefits + stamp duty rebates) make 2026 the year for women to invest.