Beyond the standard home loan interest rates set by the RBI, the Indian Government has implemented several schemes aimed at making home ownership more accessible and promoting social empowerment. Property developers like Godrej are structured to integrate these benefits, providing direct financial advantages to eligible buyers.

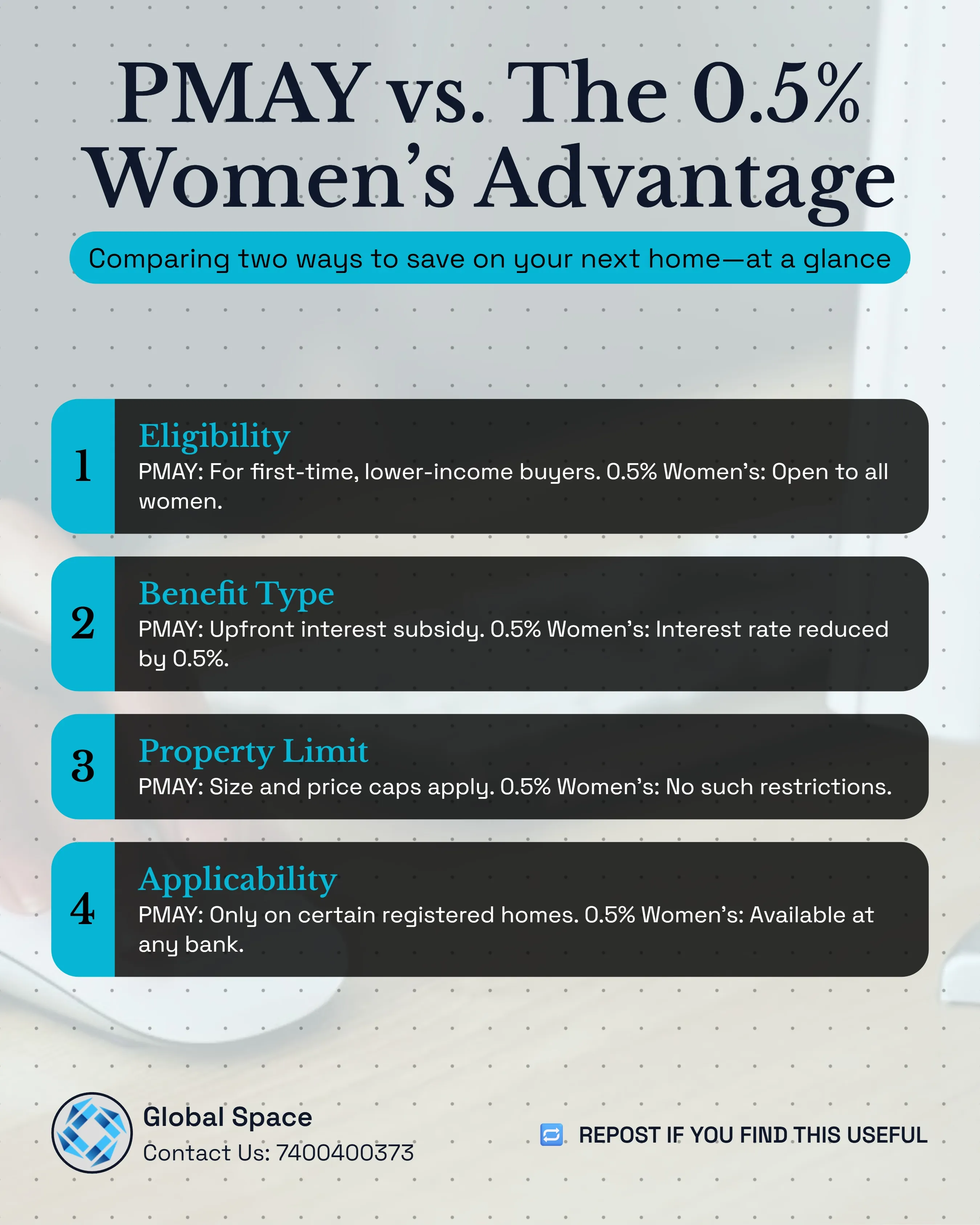

1. Pradhan Mantri Awas Yojana (PMAY)

The Pradhan Mantri Awas Yojana (PMAY), also known as PMEP (Pradhan Mantri Awas Yojana - Urban), is a crucial social scheme focused on providing affordable housing.

- Target Segment: PMAY is specifically designed for individuals who are first-time homeowners and fall into a lower-income category. This includes limitations on their salary and the rate/size of the property they are purchasing.

- Developer Integration: While PMAY might not cover all segments of a large, premium development like Godrej Kharghar, developers can register a specific segment of their project under this scheme. This allows buyers who meet the government's eligibility criteria (first-time buyer, low income) to receive the benefits available under PMAY.

- The Benefit: For those who qualify, PMAY offers benefits that can include subsidies or other financial support, significantly easing the burden of ownership.

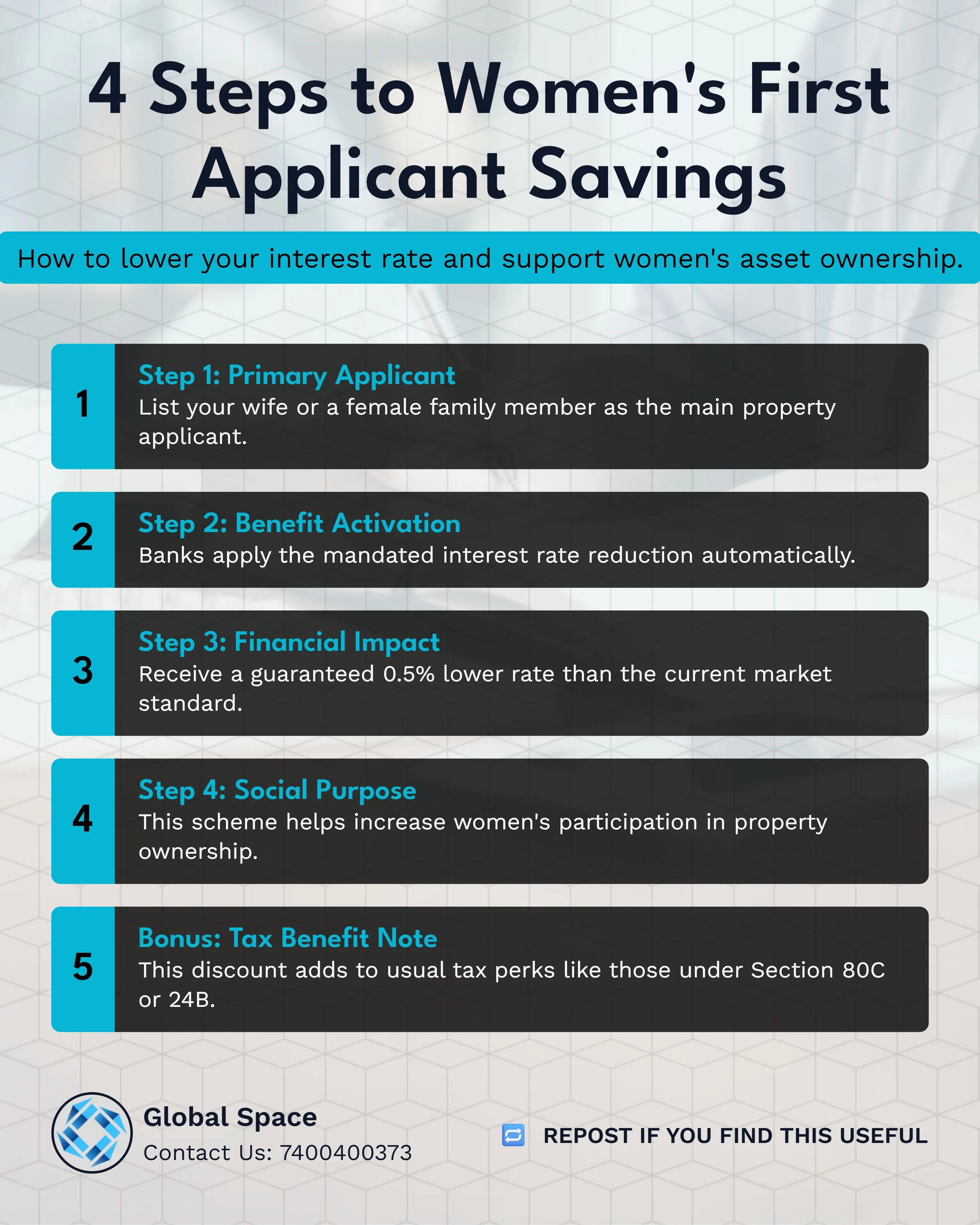

2. The Women’s First Applicant Incentive

One of the most widely available and impactful schemes is designed to encourage women's ownership of property. This incentive works across India and is not subject to income or property size limitations, unlike PMAY.

- The Scheme: If you purchase a property and keep your wife or any other female in the family as the first applicant on the property papers, you automatically qualify for a benefit.

- The Financial Gain: The government mandates that the home loan interest rate will be 0.5% lower than the prevailing market rate offered by any bank. For instance, if the market rate is 8.5%, the buyer would receive a loan at 8.0%.

- Purpose: This scheme is part of a larger initiative to empower women by bringing them to the forefront of asset ownership.

3. Regional and State Government Schemes

In addition to the pan-India schemes, some State Governments introduce their own regional schemes, often offering unique benefits tailored to local market conditions.

Example: Haryana's Deen Dayal Scheme: This is a prime example of a state-specific initiative. The Deen Dayal Scheme in Haryana offers a dual benefit: not only is the interest rate lower, but the buyer also gets a better Floor Space Index (FSI) allowance, which can increase the overall value and usability of the property. These state schemes depend on the specific location and developer's registration.

Maximizing Your Savings

As a property buyer, it is essential to discuss these schemes with the on-site finance team. While the interest rate is ultimately decided by the government at the State level, or the RBI at the national level, the availability of these schemes provides direct, tangible savings. By ensuring your eligibility for PMAY or utilizing the Women's First Applicant Incentive, you can significantly reduce your long-term housing costs.