Kharadi has emerged as a rare "sweet spot" in Indian real estate where immediate rental demand meets high long-term capital appreciation. For investors looking at the 2026-2030 horizon, the micro-market offers a compelling narrative of structural growth and high passive income.

1. The "Shocking" Residential Yields

While traditional residential yields in India hover around 2-3%, Kharadi is consistently delivering 4.5% to 6%, with some premium segments hitting the 7-9% mark.

- Rental Demand: Driven by the massive workforce at EON IT Park and WTC, 2 BHK rentals range from ₹35,000 to ₹45,000 per month.

- Managed Assets: For those seeking even higher returns, serviced hotel apartments adjoining the IT parks can offer up to 12-20% ROI annually.

2. Capital Appreciation Projections

Property prices in Kharadi have seen a sharp rise, appreciating by 30-40% over the last five years in some micro-locations. Currently, prices are growing at an annual rate of 8-10%, fueled by the 28 upcoming IT parks and the completion of the Pune Metro Phase 2.

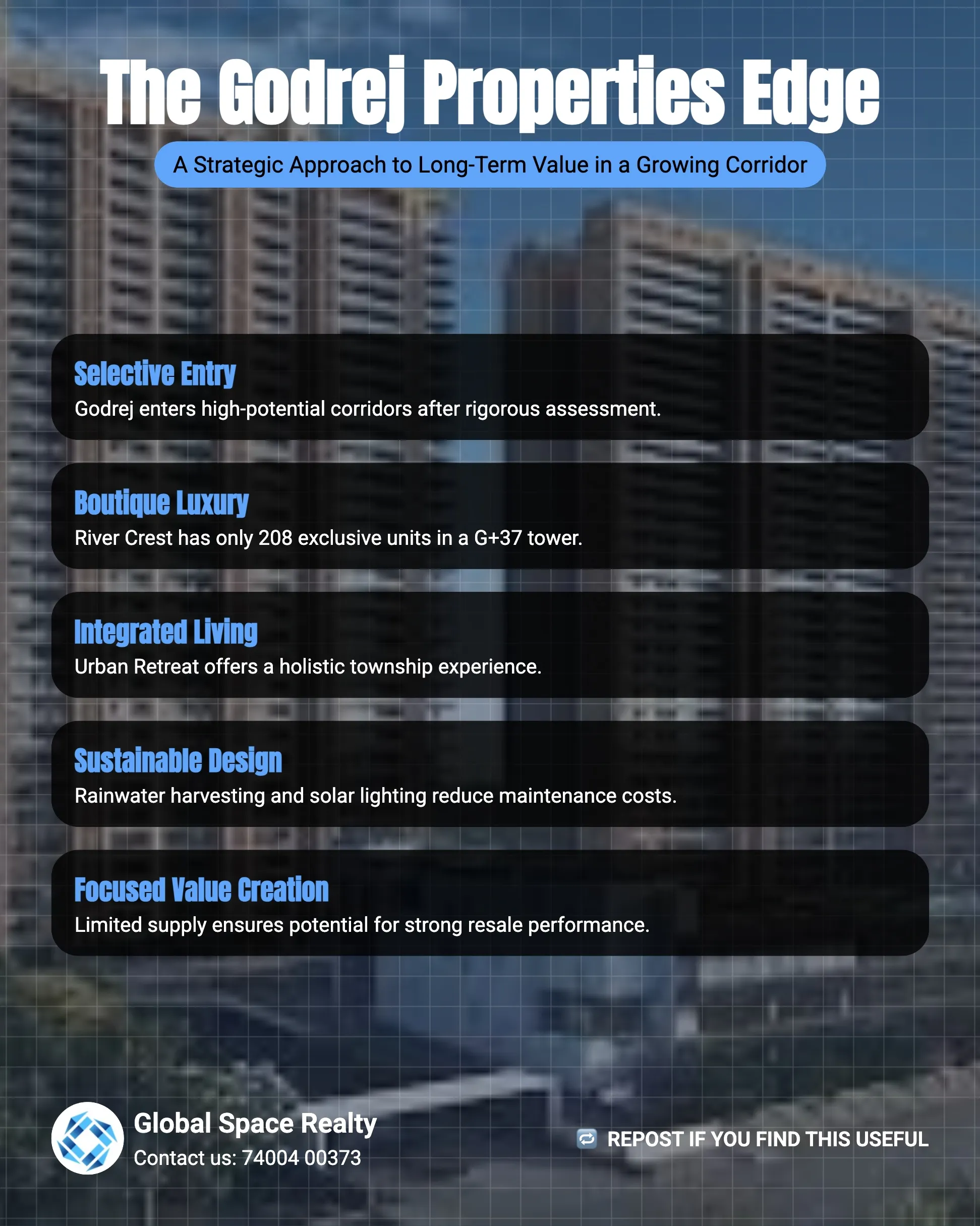

3. The Godrej Properties Edge

As an official channel partner, we highlight Godrej’s strategic entry into this high-growth corridor. Projects like Godrej River Crest (Boutique Luxury) and Godrej Urban Retreat (Integrated Township) are designed for long-term value:

- Exclusivity: River Crest offers only 208 units in a G+37 tower, ensuring scarcity and high resale value.

- Sustainability: Rainwater harvesting and solar lighting reduce maintenance costs, further improving net ROI.

4. Key Investment Indicators (2026)

| Configuration | Avg. Capital Value | Rent Potential (Monthly) |

|---|---|---|

| 2 BHK | ₹99L – ₹1.2Cr+ | ₹35,000 – ₹45,000 |

| 3 BHK | ₹1.5Cr – ₹2.3Cr+ | ₹45,000 – ₹60,000+ |

| 4 BHK | ₹2.5Cr – ₹3.1Cr+ | Corporate Lease TBD |

Conclusion

Kharadi isn’t just a real estate hotspot; it’s a smart wealth-building move. With tight supply in Grade-A commercial spaces and a booming professional demographic, the area is poised for another decade of outperforming the broader Pune market. Secure your asset now before the next wave of infrastructure-led price hikes.